@Abizzz

I agree with some of your arguments. I´d love to reply too all points, but it would just get too long. I´ll just try to focus on things that are relevant for dott-frank:

I don´t understand how anyone can maintain the idea, that banking regulation is anything but a complete and utter failure. We wouldn´t have major finance/banking crises every few years, if these agencies would help. There is just no evidence, that things would be worse without all these rules. Additionally it is myth, that there was this great period of deregulation. Yes, some regulatory standards were repealed, but others were added. The budget for oversight+regulations and the amount of agencies never decreased.

Following section 38c of the FDIA, which regulated capital requirements pre-dott-frank, the regulatory agencies had the power to require any capital requirement that they deemed necessary. It wasn´t for a lack of power, that they didn´t force banks to hold more capital; it was a lack of understanding of the risk.

Lets take a look at some developments, that might help us to understand if Dott-Frank improved the situation:

1) Almost the entire increase of core capital of American institutes is down to the basel III process, which was implemented (in part) month before Dodd-Frank.

2) From the passing of Dott-Frank the ratio of capital to assets increased about 0.1% (11,1% => 11,2%), which is negligible. Most of that improvement is down to an increase in undivided profits.

3) The ratio of common stocks+pps to assets declined (!!!) from 0,4% to 0,3%. (“skin in the game”).

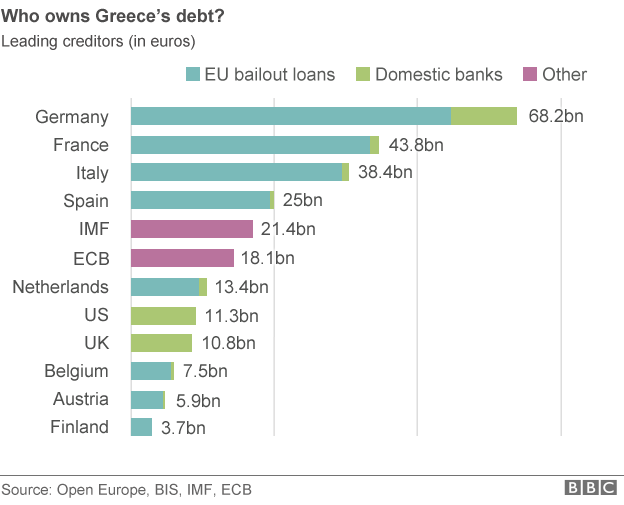

4) The slight increase of bank capital to risk weighted assets is mostly down to “gaming the system”; banks shifted their investment into assets, that have lower risk weight and I already pointed out that risk-weights are set by politicians who have no interest to look at the underlying risk of these assets. The idea that governments bonds don´t have any default risk makes no sense, while the FED still has to push the MBS security market. The idea that holding these assets makes the system more stable is ludicrous.

So before I digress further: There is no evidence at all that Dott-Frank decreased the risk even the tiniest bit, while there are many many many (unintended) band consequences associated with it. Even I know that the current system is not stable, yet somehow all those great regulatory agencies seem to miss that. The only “upside” for America’s banks is, that the EU banking system is in such a horrible state, that even a turd would shine like a diamond next to it.

The EU banking system will crash and burn sooner or later (well…no…they’ll get bailed out, so no reason to panic

). Obviously Europe also has all these new oversight rules and agencies, which are failing to achieve anything. Their failure to address the issue is so fundamental and all-encompassing, that I don´t even have words for that. It is the ultimate prove that nobody should trust politicians and regulators with these issues. They don´t understand it and follow bad incentives.

The only solution is to demand higher capital ratios and get rid of all the bad legislation that distort the market. Sadly politicians don´t want that, because it would run contrary to their new-Keynesian ideas of high deficits. They can count themselves lucky, that the voters will always ask for more government intervention after each crisis. A cynic would say that they create problems, so someone needs them to solve the mess. Rinse and repeat.

I would like to address your remarks about “too big to fail”, the crisis of 08 or the situation in Europe. I don´t agree with your opinion on these issues, but any useful reply would go beyond the scope of this forum. You clearly know a lot about all these things, so answering with a lazy 2 liner wouldn´t make any sense.

PS: If you don´t believe me, listen to Larry Summers, who is more or less the ultimate insider when it comes to economic policy of the Democratic Party (and consequently dott-frank). He served under Clinton and Obama. He comes to the following conclusion:

(…) Harvard PhD candidate Natasha Sarin and Harvard Professor Lawrence H. Summers challenge a widely-held belief that major financial institutions in the United States and around the world are safer today than they were prior to the crisis because of regulatory changes made in the wake of the Great Recession.

In their paper, which has implications for future financial regulation and supervision and challenges the views of many officials and financial sector leaders who believe the system is safer now, Sarin and Summers examine a variety of market measures of risk—including stock price volatility, option-based estimates of future volatility, beta, credit default swaps, earnings-price ratios, and preferred stock yields.

Using extensive data on the largest financial institutions in the United States (Bank of America, Citigroup, Goldman Sachs, JP Morgan, Morgan Stanley, and Wells Fargo) and around the world and mid-sized institutions in the United States, Sarin and Summers find no evidence that markets regard banks as safer today than they were before the crisis, despite large decreases in leverage. In fact, measures of volatility and beta appear to be higher post-crisis than they were pre-crisis. (…)

). Obviously Europe also has all these new oversight rules and agencies, which are failing to achieve anything. Their failure to address the issue is so fundamental and all-encompassing, that I don´t even have words for that. It is the ultimate prove that nobody should trust politicians and regulators with these issues. They don´t understand it and follow bad incentives.

). Obviously Europe also has all these new oversight rules and agencies, which are failing to achieve anything. Their failure to address the issue is so fundamental and all-encompassing, that I don´t even have words for that. It is the ultimate prove that nobody should trust politicians and regulators with these issues. They don´t understand it and follow bad incentives.